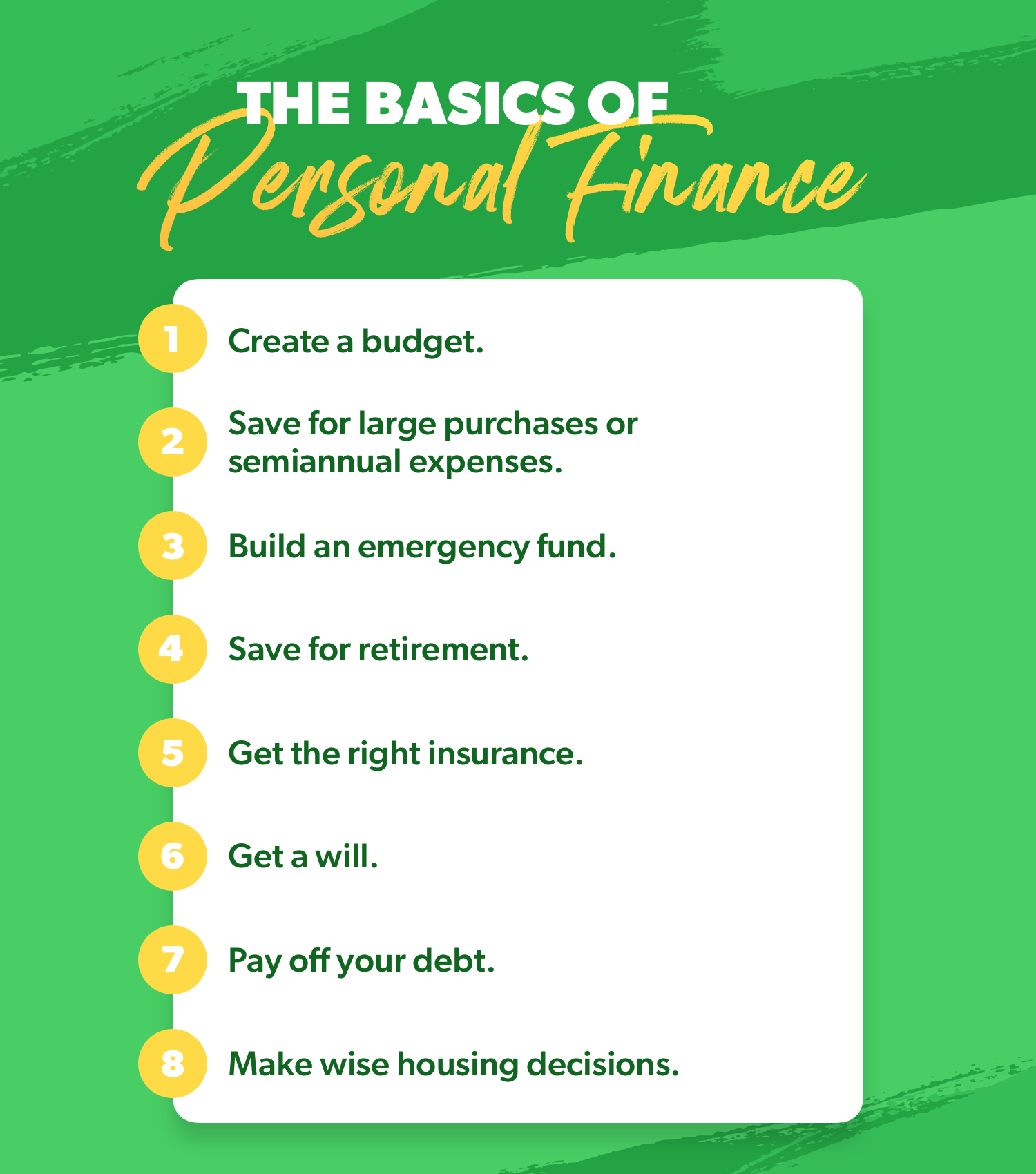

One of the most basic principles of personal finance is creating an emergency fund. This money can be accessed when you need a safety net and has no other use. Many financial advisers recommend keeping three to six months’ worth of expenses in a savings account. The first step is to set aside $1,000 in an emergency fund. You can increase this amount later when you need a larger sum. Similarly, saving a month’s worth of expenses is a good place to start.

Personal finance is an essential part of life. It involves managing money, setting financial goals, and making smart decisions. It involves learning to create a budget, managing your debt, paying off debt, and saving for retirement. It also involves dividing your income and planning for taxes. By following these principles, you can manage your money in a more effective way and avoid becoming a victim of consumer debt. Ultimately, personal finance allows you to become more independent and make better decisions about your finances.

The principles of personal finance help you avoid debt and stay out of it. Whether you’re maxing out your credit cards, missing payments on your loans, or just struggling to pay your bills, you should have a plan for your financial future. Some research shows that 39% of U.S. households do not have enough cash to cover a $400 emergency, which means that most households would turn to debt to pay for an unexpected expense. A bankruptcy is a huge blow to your financial profile and it takes many years to rebuild it.

Also Read: Low Interest Loan Apk in Indonesia (2022)

Personal finance is about understanding your financial situation and achieving your goals. It helps you separate your wants from your needs. Educating yourself on personal finance is essential in ensuring that you can achieve your financial goals. The education system has limited courses related to personal finance, but you can always learn the basics through free online resources. You may find it useful to consult an expert when pursuing a career. You can also learn how to plan for your retirement and save for retirement.

A personal finance plan can help you achieve your goals and avoid debt. By building a budget and reducing your expenses, you can create a financial plan that meets your goals and fits your lifestyle. You should also consider your income and expenses to ensure that you can afford what you want and save for emergencies. As a result, personal finance helps you control your spending and invest for your future. If you have a high income, you should not spend it on non-profitable assets until you have reached your monthly savings goal or reduced your debt.

Also Read: Compare Instant Cash Loans And Learn How They Work

You can learn all about personal finance on the web. Several popular online courses cover various aspects of the subject. The Massachusetts Institute of Technology and Harvard University have created an online learning platform called EdX. “Personal finance” is a great resource to learn about personal finances. These courses cover topics like credit, determining the value of your income, negotiating credit cards and insurance. In addition to these, you can even start a business or start your own home.

Hi there! This is Devin Haney. I am a Freelancer. I love to Blogging. I would love to connect with everyone here. On relaxing Sunday afternoon you will find me.