A combined cash ISA account is a type of ISA that allows you to save and invest your money in one account. This type of account means that you can take advantage of the tax-free benefits of an ISA while also earning interest on your savings.

The two types of combined cash ISAs are fixed rate and variable rate. With a fixed rate combined cash ISA, you will earn a set amount of interest on your savings, regardless of changes in the market. With a variable rate combined cash ISA, the interest rate can go up or down depending on market conditions. Some combined cash ISAs also offer additional features, such as access to ATMs or online banking. However, these features may come with a higher interest rate. Be sure to consult with an advisor before starting, such as this one here.

Why should you invest in a combined cash ISA in the UK?

You should invest in a combined cash ISA in the UK for many reasons. One of the main reasons is that it offers tax-free savings, which means you will not have to pay any taxes on the interest you earn from your account.

Another reason to invest in a combined cash ISA is that it can offer higher interest rates than other savings accounts because the funds in a combined cash ISA are invested in different assets, such as bonds and stocks. This diversification can help to protect your money from volatility in the markets. Finally, investing in a combined cash ISA can help you reach your financial goals sooner because the tax-free benefits can compound over time.

How to open a combined cash ISA in the UK?

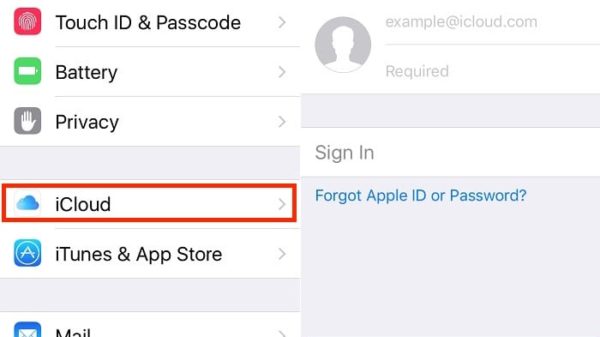

Opening a combined cash ISA is easy and can be done online, in person, or by post. To open an account, you must provide your details, including your name, address, date of birth, and National Insurance number.

You will also need to provide information about your employment status and income. Once you have provided all the required information, you can choose how much money you want to deposit into your account and begin earning interest on your savings.

What to consider before opening a combined cash ISA?

Before opening a combined cash ISA, you should consider a few things, such as the interest rate, fees, and features.

The interest rate is crucial because it will determine how much money you earn from your savings. Look for an account with a competitive interest rate to maximise your earnings.

Also, consider the fees associated with the account. Some accounts may have monthly or annual fees, while others may not have any fees at all. Make sure to compare the fees before choosing an account to find one that fits your budget.

Finally, consider the features offered by the account. Some accounts may offer ATM access or online banking, while others may not. Choose an account that offers the features you need and want.

What are the risks associated with a combined cash ISA?

There are a few risks associated with a combined cash ISA:

One of the most significant risks is that the interest rate on your account may change. You will earn less money from your savings if the interest rate decreases. However, your savings will earn more money if the interest rate increases. Another risk to consider is that the value of your stocks investments may go down, which means you could lose money if you withdraw your funds before the market recovers.

Finally, there is always the reality that the bank or building society where you have your account could fail. This failure would mean losing access to your money and potentially losing some or all of your savings.

The bottom line

A combined cash ISA can be a great way to save money because it offers tax-free savings and the potential to earn high-interest rates. However, some risks are associated with this type of account, so research the account before investing your money. Novice traders in the UK should always consult with a financial advisor to get the best advice for their situation.

Hi there! This is Devin Haney. I am a Freelancer. I love to Blogging. I would love to connect with everyone here. On relaxing Sunday afternoon you will find me.